Table of Contents

Short Term Investing

Ah investments, some are for the long haul and some… short term.

If you are looking for as many quick gains as possible, then you may fit the bill of being a scalper. If you are a scalper you may align perfectly with being able to invest in short term gains. This would mean going for a large amount of trades and taking mass advantage of daily price fluctuations. You may also align with short term investing if you are an active investor. Active investor as in watching and moving your portfolio and positions weekly, daily or more.

Short term investing in daily, weekly, or monthly time frames can be highly profitable when done correctly. One part of short term investment strategy is investing in forex. Forex can yield high profits quickly, but with all investments it can also cause losses just as fast.

Short term investing is defined as any investment that can be cashed out with a profit in five years or less. Other than forex. CDs, bonds, treasury bills, high yield savings accounts, and money market accounts.

Investing short term allows you to invest in a more liquid option. This liquidity means you can withdraw at any time or with minimal wait time after beginning an investment.

Risk of Forex

Forex yields some high profits, but is also highly volatile compared to other investments. The high growth rates are a tradeoff for the time it can take to grow. Growth in forex is determined by the value of the currency…and the better the economy, the higher value the country’s currency holds.

Short term investing also tends to be volatile due to the nature of how quick the desired gains are. This makes pairing it as an investment strategy with forex as a method ideal.

Benefits of Forex

With volatility coinciding with risk, this can also be a benefit for short term investing in forex. A spike in value of an invested currency can increase the value of your portfolio at a pace that would have taken months with other investment methods.

Forex is considered to be a highly liquid investment option and with its availability 24/7, an excellent option for short term investing. As an added bonus, forex can benefit from higher volatility and is an expansive, global market.

The sheer liquidity that forex has is one of the greatest advantages it holds. Money is a universal good, everyone needs it. No matter how materialistic you may or may not be, money is needed to function in modern society. The more liquid an asset is, the easier it will be to convert that to actual money. Forex is one of the most liquid options available to invest in…again making it one of the easiest to then withdraw your funds from and be able to spend, use, and/or reinvest.

Why Forex is a Good Short Term Choice

Forex holds some major stake in the short term market. This is because there is an ability to have high leverage with the investments. This does come with higher risk, but if it plays out well there are large rewards to cash in.

There are options to have a 1:50 stake. This means for a $1 put in, there is a possibility of a $50 return…theoretically speaking that is. This also means at that leverage ratio, if you have a loss it will go to that same tune as the win would have…but in the opposite direction.

Forex offers chances at the HIGHEST returns for short term investing out there. If the market is played well, it can yield up to about 10%, although for most people it may not be that high. Again, these yields come with risk being a balancing factor though. If you want to reap the benefits of greater rewards, you have to accept greater risk.

The Buy and Hold Strategy

Forex does hold the possibility of being able to use the buy and hold strategy with investing. This is another buy low and sell high technique but rather than just focusing on that aspect, the trader will hold onto the bought currency until the trade off is higher. This is a technique that can be implemented either long or short term, but with the natural volatility of forex there is a possibility of this playing out much sooner than other investments.

The buy and hold strategy can work short term, but is typically seen as more favourable as a long term investment strategy. This is due to some positions that can show to have greater improvement while waiting for the best growth.

Fundamental Trading

Fundamental trading takes a classical approach to a newer investment strategy. Fundamental trading follows exactly that…the fundamentals of the market. As an investor, you would read into market fluctuations and world news to see the best opportunities for profit gains. This means you need to be knowledgeable and willing to learn to succeed with this investment type.

Day Trading

Fundamental trading takes a classical approach to a newer investment strategy. Fundamental trading follows exactly that…the fundamentals of the market. As an investor, you would read into market fluctuations and world news to see the best opportunities for profit gains. This means you need to be knowledgeable and willing to learn to succeed with this investment type.

The Carry Strategy

Another short form investing option for forex is the carry strategy. This is a “sub-type” of buy and hold. The carry strategy uses interest rates as a leverage point. This means choosing a currency that has a low interest rate and selling that and then buying a currency with a higher interest rate for payouts.

Carrying may not be the best option, but it can work. Often interest rates are small and may not offset the risk that is taken with using the strategy.

Trend Following

A form of short term investing with forex is trend following. Trend following can go on a daily or weekly basis. Trend following is fairly self explanatory….checking into both daily and weekly charts and reports to spot trends in currency fluctuations.

You HAVE to be fully prepared when using this technique. Trend following requires you to study the market in depth, have a preset stop point AND target profit margin in place. Once a trend is found, determine the best time to enter the market, then watch and follow through to hopefully reach that target profit point.

There is also counter trend trading; this is the polar opposite of trend following. This technique looks at market trends and takes the opposite position of the trend…banking on that trend switching.

Signals to Watch

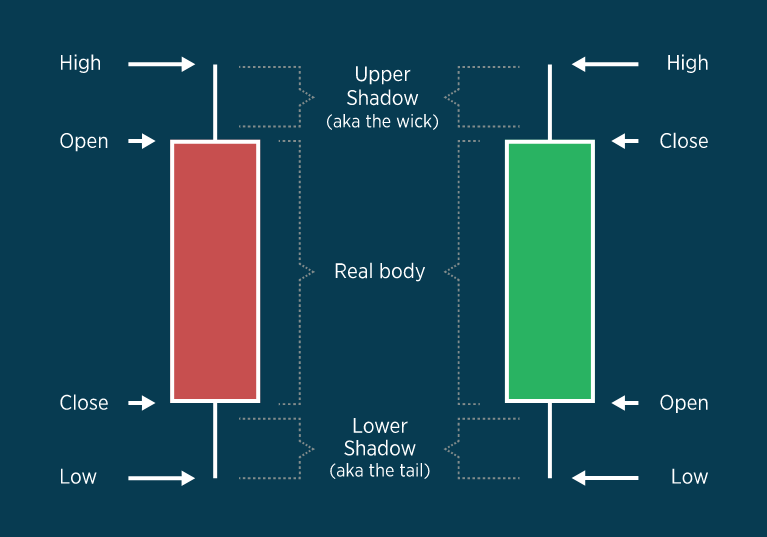

There are two main signals to watch with short term forex investing. These signals are the candlestick and bar signals.

Candlestick signals consist of an open, a wick, and a close. The bar goes green if the close is ABOVE the close and red if it is BELOW the close. Each candle has two wicks as well. There is an upper wick and a lower wick. The upper wick holds the prices higher than the close price and the lower wick holds the pieces lower than the close price. These are gathered from all price fluctuation for the day.

Candlesticks also offer three distinct patterns. These include the shooting star, hanging man, and hammer. The hammer has a small body and a low hanging wick, this typically signals a reversal in trend. A hammer formation can be taken advantage of with a tight stop-close; they also signal a predominant bear market. A hanging man has a short upper wick and a very long lower wick, this is a bearish type of market but not as heavy in that direction as the hammer is. The hanging man can also be a start signal to a downward trending market. A shooting star is opposite the hammer. It has a small body and a high shooting upper wick; this one signals a predominantly bull market.

Bar signals are comparable to candlesticks, but appear different. These appear as straight lines with a clear stop point and “wick”, but unlike the candlestick there lacks a block formation on the bar itself. For bars, if a bar is red then it signals a bear market and if the bar appears green (or possibly blue depending on your trading platform) it signals a bull market.

Both bars and candles represent units of time. For example, if your chart is set at fifteen minute intervals, each bar or candle represents each fifteen minute interval.

The Time Investment

Short term investing has a trade off for personal time versus investment time. Short term investing requires more time to observe and track to be sure when a position is sold it is at its optimum profit point. This means you must also take the time to study the markets and be well versed and educated before the investing starts to be best prepared for the venture.

Other Short Term Investments

Forex isn’t the only option for short term investing. Forex could be the best option for short-term, but for the sake or diversification, it can help to explore additional options. Aiming for higher yields leaves forex the leader of the short-term pack and other options trailing behind giving way to less risk, but lower yields.

CDs

A CD is a certificate of deposit. These are offered by banks and pay out what is considered to be high interest rates. CDs average 3-5 years for returns, but they can range 1 month to 10 years. With these the longer the investment you make, the higher the potential yield.

Monthly interest payments may be able to be pulled out, but there may be more by opting to hold out for an end lump sum. There can be fees attached to withdrawing CDs before they are fully mature though.

The average rate of return for CDs range .5-3%.

Bonds

Treasury securities fall under the realm of bonds and are backed by government credit. Bonds are considered low to no risk. Depending on the security type invested in depends on the rate of return. Some have a rate of return of .5-2.5% while others have an average return rate of 1.9-2.4%.

A few other bond types can yield around 3% or a little more in some cases, there can also be fees associated with these accounts though.

Although very minimal risk, the low rate of return can be a large draw back.

Municipal bonds are a higher return rate bond though of near 4%, but with higher return rates come higher levels of risk. If their interest rates rise then the value of the bond goes down.

Roth IRAs

Roth IRAs are a short term investing option to a point. Like other options, you can withdraw without a fee, but the longer it sits, the more it matures. Being able to withdraw early can help in cases of emergency, but it is better to not make early pay-outs.

Roth IRAs are great as a retirement option rather than just a short-term plan.

These can yield up to a 6% annual return, but shows the greatest yields with continual deposits and letting it fully mature until retirement age.

Making Short Term Work for You

As a whole, short term investing can help your portfolio and overall investment strategy get some quick…and maybe steep….wins.

Having short term investments allows there to be a hedge to protect your long term investments if done correctly and well. Quick gains allow for a greater ability to avoid touching long term investments that take more time to mature. These are great for those true emergency situations where if there were not any short term investments to pull from, a dip would have to be made into the long term fund…which can come with heavier fees.

The goal of short term investments are to make as big of a win as possible in the shortest amount of time. This can be as day traders (a more extreme example) or putting a cap on the time of the investment to less than 3 years. The strategy is to BUY LOW and SELL HIGH. This allows the investor to yield a profit. Employing this concept can be a great compliment to a portfolio that is low-yielding and more conservative.

Forex trading should be noted that as it is a market that takes a great deal of knowledge and skill to properly execute. And as with any investment, can just as easily cause a loss at the same magnitude the win would have been. Forex is designed in a way that can be confusing to the user and in turn frustrating as well, so knowing how the market works and the best approach with wanting to invest short term is a necessity.

Long Term v. Short Term

Without avoiding the opposing choice, it can help to comb over long term investing and its own strengths and weaknesses against short term investing. Long term investments have potential to be less volatile…as always the market fluctuates…but the patience and time required to reach maturity and be able to actively use and withdraw funds.

Liquidity is your friend and typically short term options are more liquid than long term ones. Short term investments also tend to be more volatile and make small movements as well. Although short term investments are more volatile, long term investments can be more aggressive. This is because there is room and time to recover from taking a loss with an aggressive approach.

Long term investments are a bit more predictable in performance than short term, but the options have a bit of a switch. Any short term investment could potentially be able to be long term also, but not every long term investment is suited to switch to short term. For this thing real estate and 401Ks. 401Ks have fees attached if you withdraw too early, so any gains can be negated if you pull early. Real estate markets do fluctuate with a certain predictability, but they can hold some power in being held for years on end.

Noting on holding for years…that is the distinguishing factor for these two options. If you opt for long term investments, this probably lumps you in with passive investors…depositing money and leaving it, whether this is a single large lump sum deposit or continual deposits.

Needing to Rely on Other Accounts

Forex offers a short term gain and a long term strategy as either method for making gains. The days of being able to solely rely on a pension for retirement are coming to a close. Diversification beyond that single fund account is a necessity. If the system fails, then so does the pension itself.

A pension can be cut in half or fail outright. Having to rely on a company, the government or organizations gives way to needing to be more self sufficient when it comes to finances. All financial investments have a certain level of risk attached to them…some simply more than others.

Another note on pensions is they often operate on 60% of the pre-retirement pay rate. This is a massive cut for some. Assuming that salary is at $40,000 annually, this means a pension would pay out to a tune of $25,000 annually. Now if you are expecting a certain level of comfort you will need significantly more, especially if you are still making house payments or other long term, higher ticket loans. This gap can be filled with other investments…things like Roth IRAs (if started early enough) and SHORT TERM INVESTMENTS to fill the gaps.

Forex investing can be both that short term and long term solution to filling that pension gap if there is an ability to both afford and withstand the risk associated with the market. Just think…when you retire, what do you want to be able to do? Travel, lounge, take on new hobbies…you are going to need the funds to do that, and a massively cut pension won’t support that desired lifestyle.

The Least Liquid Assets

Thinking of the most liquid assets, there are also the least liquid assets. This does not mean to fully avoid them, but when it comes to cashing out it may be more difficult ranging in terms of the amount you can pull, the time it takes to pull out, and how much you will yield after any fines or fees attached to the option.

These assets include collectable items and plant property and equipment.

Collectable items are any of those items stashed away in a fire-safe or on a shelf or in a pawn shop…usually. These include collectable coins, stamps, and high-end art. Collectables can still reap high rewards, but finding the right buyer can take a long time to get real value for that item. If cash is needed NOW it comes at a cost of selling at a heavy discount at an undervalued price.

Plant property and equipment are slightly more liquid than a business itself that it is attached to. These sales have such low liquidity due to the high level of complexity involved with the sale itself. The contracts, wait times, valuation process, and other legal steps associated take a great deal of time, so if money is needed at an emergent level,then it is not the best option. Real estate, machinery, and raw materials associated with a business (depending on what the raw material is and the niche itself) may be scooped up pretty quickly, but as a downfall, again at a discounted rate compared to what it was bought at.

Using Pearl Lemon Invest to Gain a Forex Advantage

Our flagship product, Falcon, can help investors take advantage of the great benefit of liquidity that forex investing holds. Falcon takes a hold of the twenty four hour market as an algorithm and avoids human interaction. This can help shave off some of the nuances and steep learning required to manually trade.

As a huge benefit, Falcon has the potential to reap returns to a tune of 31% or higher annually. If you look for short term gains, funds can be available for withdrawal within two working days.