You’ve done it! Jumped both feet forward into Forex Investing.

Welcome to the world of 24-hour markets!

But now what?

You know you want to invest in Forex, but do not feel you have the skill to go about this on your own…

There is an easy solution to this though… hire yourself a Forex broker to help take some of the edge off of the uncertainty with your new venture. This leads to one more question, how will you choose the BEST Forex broker for you?

Choosing the right broker is a part of your level of success with investing in Forex. You wouldn’t just hand someone random off the street your assets right? You need to research brokers and have yourself a method in place to be able to double check who you are about to trust with your hard-earned money.

Table of Contents

First things first....what is a Forex Broker?

Forex brokers are firms that connect individual traders to a platform that allows trading within the forex market. These brokers can also be considered as financial asset salesmen.

1. Make sure the potential broker can prove security

- United Kingdom- Financial Conduct Authority and Prudential Regulatory Authority

- United States- Commodity Futures Trading Commission and National Futures Association

- Canada- Investment Information Regulatory Organization of Canada

- France- Autorité des Marchés Financiers

- Germany- Bundesanstalt für Finanzdienstleistungsaufsicht

- Australia- Australian Securities and Investment Commission

- Switzerland- Swiss Federal Banking Commission

- Dubai- Dubai Financial Services Authority

- Cyprus- Cyprus Securities and Exchange Commission

- Luxembourg- Commission de Surveillance du Secteur Financier

- New Zealand- Financial Markets Authority

2. Double check on client relations

Another factor in finding your perfect fit is be sure that clients are top priority for that broker. Look into reviews and see what people have to say about working with that broker. When push comes to shove you want to be sure that you will be able to voice any issue or concern and get a quick and accurate reply.

Reviews that outline vague replies from customer support or slow responses may be a slight red flag when looking into a broker. You don’t want to end up having an amazing on-boarding process then get dropped for any of the after-sales processes.

The forex market is a 24-hour market, so you want a broker that will address questions or needs as fast as possible. Having to wait for responses could cause potential losses for yourself or end up leaving you confused.

3. Look at additional costs

Brokers will often take a cut of profits made as commission. Depending on the company, the commission percentage and additional fees may be higher.

While checking into those hidden fees, you will want to look at the ease of being able to withdraw your funds. Obviously you will want a fee-free, hassle-free process, but there are brokers that may charge a fee for having you withdraw your profits. So be sure you won’t get extra charges or the run-around for this.

These commissions and fees usually run based on fixed or variable spreads, so be sure to ask the potential broker what their services will cost.

4. What about their trading platform?

The bulk of the trading done with your funds will be done via their trading platform. This means you will want access to the platform to view your trading performance.

Double check what the platform and user dash will show you and how accurate the numbers are that you are shown. You will want to be able to navigate your dashboard with ease and be able to read the information and reporting presented to you.

Their platform should also entail a high speed of execution. If you opt to manually trade and opt to purchase a currency at a certain price. You will want to ensure the platform will be able to be fast enough to secure that price. Especially when factoring some variance in pips can make trading more difficult.

Another obvious mention on their platform is double check if it is buggy. If their platform has feedback outlining unresolved bugs and glitches, you may want to steer clear of that business considering you will be pouring your funds into that platform.

5. Funds to start with

Think to yourself, you know you want to invest in Forex, but how much do you want to start with?

Another item to factor in choosing a broker is what their minimum deposit is to get an account running.

The more you, theoretically, invest the more you will make assuming the market and your portfolio has an upward trend. But you need to factor how much you want to start with and how much you will make as recurring or one time deposits through your investment journey.

Asking the starting requirement can help you find your best fit if you go into your research with knowing what you want to begin with, continue with, and hopefully achieve.

Although not a starting fund, one other quick fund note is to also check for minimum account balance requirements while looking at start-up costs. Depending on your needs, the less you need to keep an active account may be better. This factor also can help you later on in budgeting how much you may want to withdraw from your account.

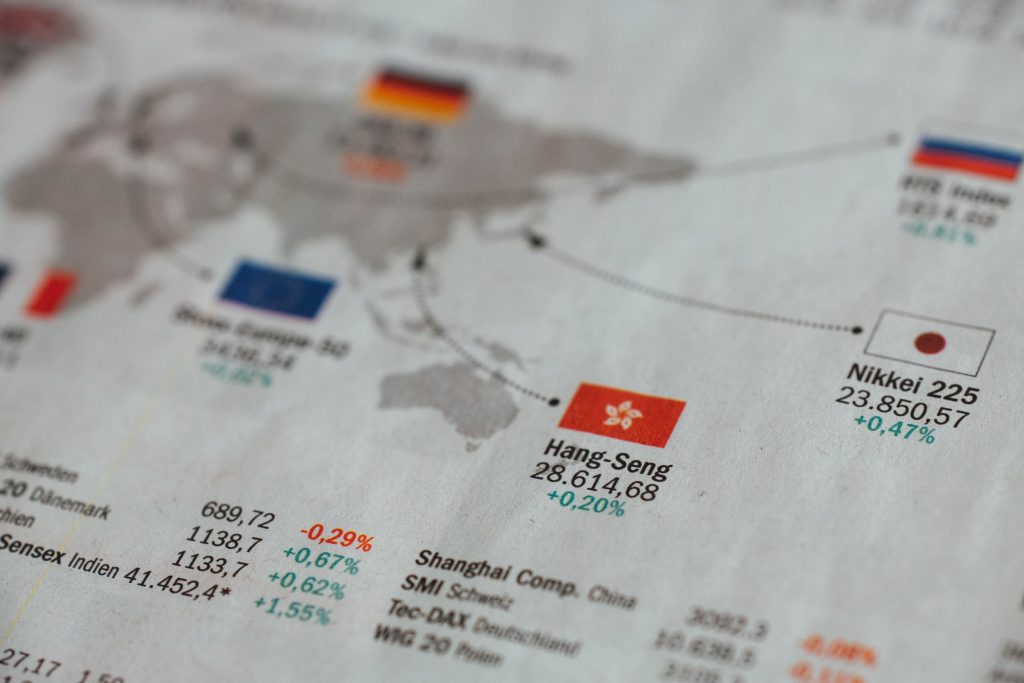

6. Look at available currency pairs

As the client, you want to be able to get what you want and are hoping for. With this is the ability to choose and invest in a variety of currency pairs. Currency pairs will tend to fall under three main categories; major, minor and exotic. There are 180 legal currencies globally, so theoretically you can trade once currency with any of the other 179. On average brokers offer 40-70 pairs to trade.

There are a wide variety of currency pairs available, but you will want to ensure that the most popular pairs are available to you to be able to trade. So be sure that when you are about to choose your broker, what you want to invest in will be there as an option.

If you haven’t looked at these pairs yet. There tends to be four pairs that are the most popular on investor’s lists for desired pairs. These follow as:

- USD/CHF- US Dollar to Swiss Franc

- USD/EUR- US Dollar to Euro

- GBP/USD- British Pound Sterling to US Dollar

- USD/JPY- US Dollar to Japanese Yen

There are three other pairs and between these 7 they tend to be the top traded pairs:

- AUD/USD- Australian Dollar to US Dollar

- NZD/USD- New Zealand Dollar to US Dollar

- USD/CAD- US Dollar to Canadian Dollar

7. Check on order entries

Your dashboard of your account should be able to display a variety of different entries. These entries, or stops, are meant to help create the best performance on your account and add some security in preventing too much slippage. There should be a minimum of six main entry or stop displays.

- Stop order– buy or sell order turning into a market order at the chosen entry price.

- Limit order– buy or sell order that can only be filled at the chosen entry price… or better.

- Market order– an order that is IMMEDIATELY filled at the best market price, typical in situations creating excessive slippage.

- Stop-limit order– a conditional buy or sell that uses two price values, a stop and a limit.

- Guaranteed stop loss– an order that is GUARANTEED to be filled as long as it passes at a set price.

Close all– this will close ALL available positions at the best price and is usually done if there is excessive slippage due to fast or high changing market conditions.

8. Look for additional value

Choosing a broker can be comparable to choosing a business in any niche of service industries. You want to find the most value at the best price.

Bonuses for a forex broker may include client education. Education may include access to informative blogs, informative newsletters, industry updates, or a well broken down dashboard to help you best digest the information before you.

These small bonuses can be a tie-breaker when choosing your broker. Making sure you are well informed and feel you are getting the most value for your investment is critical on your customer-journey path.

It is important to note the distinction between a bonus and a promotion. Getting your value for your money is something to look for, but this also means to be wary of promotions. Promotions can tie back to ensuring a broker is certified and legitimate. An overly promoted brokerage that seems to be adding too much “sugar” to the deal may not be as great as they seem.

One such deal may be “invest $2000 and get $100 free.” Some may think “hey free money right”, but avoid that. It may seem like an easy bonus, but sometimes this bonus can interfere with withdrawals because part of that money is considered the broker’s.

This may not mean it is a “bad” broker, but rather just the hidden deal with it. Simply put, you could still apply and make note you do not want to be included in the special offer.

9. Find a broker that meets your STYLE

We have our own unique style and touch to the way we conduct ourselves. Your investment style is no different. When looking for the best Forex broker for you, this makes it equally important to have a broker that matches or meets your investment style.

In the world of Forex, there are a handful of “typical” investors:

- Swing Trading– Swing traders won’t necessarily look for tight spreads, but rather an ability to hold a position overnight. These trade types may trade less frequently than other types, and aim to buy low and sell high no matter the time of day they may close out.

- Day Trading– Day traders look for brokers with tight spreads, but not as tight as scalpers will want. These people trade during the day and close out their positions by the end of their trading day.

- Scalping– Scalpers are looking for the fastest profit possible. These people tend to enter and exit marketing quickly and have short-term outlooks. This type of trader needs a broker that offers the tightest spreads available.

- Carry Trading– These traders aim at “capturing” interest rates in their portfolios. Two currencies are looked at and the strategy follows: going long a high-yield currency and short a lower-yielding currency.

- News Trading– News traders will want a broker that provides as much information on a daily basis in regards to world news and financial news as possible. These traders use world news as an indicator of what is or may happen in a certain market.

- Trend Trading– These traders look at overall trends to help determine the best possible options for themselves. Trend traders opt to look for the most attractive rollovers or swap pricing options.

So, which style is most like you? Keep this in mind when looking at your broker options. You want the options you desire to be available.

10. Ask your friends

Not everyone invests in forex, but if you have someone in your close network that also invests use them as a resource. Ask them who they use and why they chose this. Go into as much detail as possible.

If your friend aligns close to you in styles, desires, and goals then it can be viable to look at the same broker they go through. Or if your friend is opposite to you, this may hint at possibly not wanting the same broker.

As a disclaimer though, brokers often offer a variety of deals, packages, or trade ability. So your friend may align with one package and you another that can still be housed under the same company.

11. Head to directories

Think about it…when you are looking for a new product or service, where do you go? Google, right. Just like any other product or service, Google can serve as a helpful tool in aiding in your search to find the best forex broker for you.

Niche directories and review sites can be a gold mine of information to find consumer feedback on a potential broker. This holds especially true if you do not have many, if any, people in your immediate network that are already investing in Forex.

Review sites should be taken into consideration, but may not be the most “reliable.” Many new traders will lose some deals simply due to the market but will blame the broker for that, so be careful of how much weight you give to a review.

By searching “best Forex brokers (Your Country)” you can yield the best results for those that are local to you. Directories will also rank companies based on performance and other factors depending on the directory itself.

Directories may also highlight business awards. These can be a positive highlight to the company if they have previously been top voted as best in the past and currently. These can help give an added benefit to being secure in having the best broker.

12. Test a demo account

A demo account is an account opened that allows you to practice trading and test out the platform while using fake money. The demo allows you to see how the platform will behave and get a better feel at how your broker runs spreads, trade execution, and more.

13. Do you only want to trade Forex?

Another item you can factor is decide if you only want to trade Forex or if there are other investment opportunities you would like to enter.

Some brokers will offer additional trading opportunities like cryptocurrencies (bitcoin), stocks, exchange-trade funds (ETFs), or contract for differences on things like commodities or indices.

So, figure out what else you may want the opportunity to invest in and use that as a factor in choosing your final forex broker.

14. Make sure they aren't scammy

15. Figure out where the broker is based

Although at the bottom of the list, figuring out where the broker is based is a big key to choosing your broker. This goes beyond the country regulation they have.

You have to choose a broker that accepts traders from where you are based. This does not mean you have to choose a broker in your country, but it may default you into doing this depending on where you may be based. Many European brokers do not allow traders from the US.

Some countries also do not allow forex trading either or are heavily regulated (more than those that allow forex trading, but have a regulatory system in place).

Countries that are restricted include:

- Ukraine

- Egypt

- Russia

- Nigeria

- China

- South Africa

Countries that have banned forex trading include:

- Israel

- France

- Belgium

- North Korea

- Malaysia (Malaysia is starting to have brokers based here, but it is so new it may need to be approached with greater levels of caution)

- Bosnia Herzegovina

- Pakistan (and any other country with Sharia Law)

- India (there is regulations on the way citizens trade by the Securities and Exchange Board of India)

16. Dealing or non-dealing desk

A dealing desk can be thought of as a casino. The house always wins… so the dealer (broker) aims at winning. If you lose on a deal, they win…their capital is used against you.

A non-dealing desk allows you to trade directly to the market, so the broker wins when you win. Non-dealing desks have a tendency to not offer demo accounts, so if a demo account is important to you, check into whatever desk type you prefer plus if a demo account is available to run.

Using this guide

Although these tips are not exhaustive, it is exactly as mentioned…a guide. When starting your investment journey it is important not to get caught up in the excitement of it. Take the above tips and write out your desires when getting ready to contact brokers. Create that list and take notes when contacting a variety of brokers. Compare more than just a couple forex brokers to best ensure that you are making the best choice for you.

Research is the key to success in most aspects of life, so apply your research ability to choosing your forex broker as well. Take the time to complete the necessary steps to find your perfect fit and build a positive brokerage relationship.