Day trading in the UK is growing rapidly, with over 1.8 million retail investors trading regularly according to the FCA. Yet with so many platforms available, choosing the right one can feel overwhelming. Some charge high fees, others lack strong charting tools, and a few make withdrawals painfully slow.

That’s where this guide comes in. We reviewed more than 40 platforms available to UK traders and distilled the top 20 UK day trading platforms that deliver speed, transparency, and advanced features. Whether you’re a freelancer trading part-time, a small hedge fund manager, or a serious retail trader, this breakdown will save you countless hours of trial and error.

According to Statista, the UK online trading market is projected to surpass £1.2 billion by 2026, so the competition between brokers has never been tighter. Let’s cut through the noise and highlight the platforms actually worth your time.

What is Day Trading and Why Does It Matter in the UK?

Day trading is the practice of buying and selling assets such as stocks, forex, or crypto within the same trading day. The goal is to capture short-term price swings using tools like candlestick charts, technical indicators, and real-time news feeds.

For UK traders, day trading offers:

- Access to global markets beyond the FTSE 100.

- Tax advantages when using Spread Betting or CFDs.

- A low-barrier entry point with brokers that accept as little as £10 deposits.

Whether you’re trading equities, forex, or futures, the right platform can mean the difference between a winning strategy and missed opportunities.

Quick Comparison of Best 20 UK Platforms for Day Trading

For this category, the most important factors are fees, speed of execution, charting tools, and ease of withdrawals. We’ve also included ratings and free trial availability for quick decision-making.

| Platform | Best For | Starting Price | Free Trial | Key Feature | G2/Capterra Rating | Mobile App |

| eToro | Beginner traders | £10 min deposit | Yes | CopyTrading | 4.3 | Yes |

| IG Group | Advanced UK traders | £250 | Yes | Spread betting | 4.5 | Yes |

| Saxo Markets | Professional traders | £500 | No | Multi-asset | 4.4 | Yes |

| Trading 212 | Commission-free trading | £1 | Yes | Fractional shares | 4.6 | Yes |

| Interactive Brokers | High-volume traders | £0 (tiered fees) | Yes | Direct market access | 4.7 | Yes |

| Plus500 | CFD traders | £100 | Yes | Simple UI | 4.2 | Yes |

| CMC Markets | Forex & CFD focus | £200 | Yes | Advanced charts | 4.4 | Yes |

| AvaTrade | Forex traders | £100 | Yes | MT4/MT5 access | 4.3 | Yes |

| Pepperstone | Fast execution | £200 | Yes | Low spreads | 4.5 | Yes |

| City Index | UK-based traders | £100 | Yes | FCA regulated | 4.2 | Yes |

| Spreadex | Spread betting | £1 | No | Low-cost spreads | 4.1 | Yes |

| XTB | Forex & indices | £0 | Yes | xStation 5 | 4.6 | Yes |

| Capital.com | AI-powered insights | £20 | Yes | Smart risk mgmt | 4.5 | Yes |

| Fineco Bank | Multi-market access | £100 | No | Direct Italian market | 4.0 | Yes |

| Degiro | Stock trading | £0.50 | No | Cheap EU shares | 4.4 | Yes |

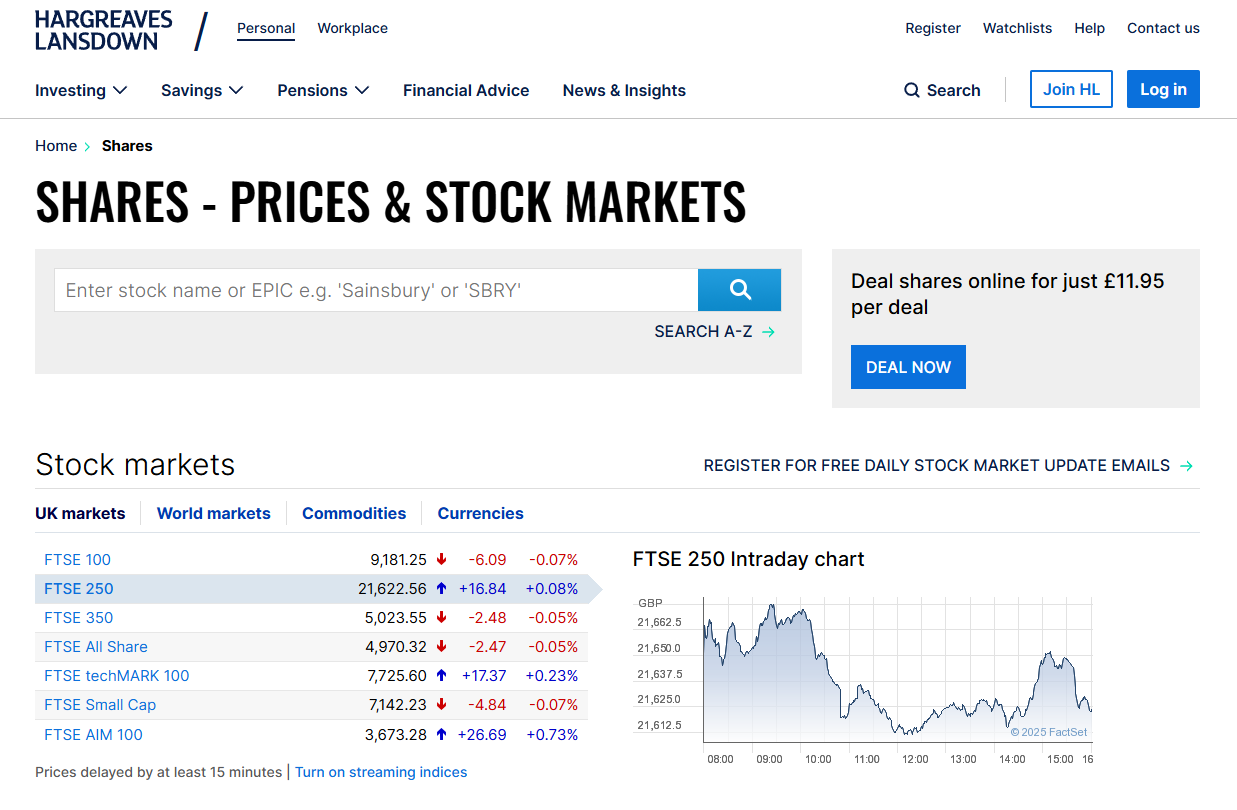

| Hargreaves Lansdown | UK stocks & funds | £100 | No | Research tools | 4.3 | Yes |

| Fidelity UK | Long-term & active traders | £100 | No | Market analysis | 4.1 | Yes |

| Robinhood (UK launch 2025) | US stock access | £0 | Yes | Commission-free | 4.0* | Yes |

| TradeStation Global | Advanced analytics | £0 | Yes | Custom indicators | 4.4 | Yes |

| Markets.com | CFD & forex | £100 | Yes | WebTrader platform | 4.2 | Yes |

*(Note: Robinhood rating based on US reviews as UK service launches in 2025.)

Best UK Day Trading Platforms in 2025

Here’s the detailed breakdown of each platform so you can see which one fits your trading style and budget.

1. eToro – Social Trading Made Simple

eToro has become one of the most popular UK day trading platforms because of its social trading feature, allowing beginners to copy trades from experienced investors. With over 30 million users worldwide, it’s a solid choice if you want exposure to stocks, forex, ETFs, and crypto under one roof.

Key Features

CopyTrading

eToro’s flagship feature lets you mirror the portfolios of successful traders in real time. This reduces the learning curve and gives newcomers a way to follow tested strategies.

Commission-Free Stocks

UK traders can buy and sell stocks with zero commission, which is ideal for day trading frequent positions without eating into profits.

Multi-Asset Access

Trade across stocks, crypto, commodities, and ETFs from one account. This is useful for diversifying short-term strategies and finding volatility outside equities.

eToro Academy

Educational tools and market updates help traders improve their knowledge while practicing on a demo account.

Mobile App

eToro’s app is beginner-friendly yet offers advanced charting for traders on the go.

Pros & Cons

| Pros | Cons |

| User-friendly interface | High forex spreads |

| Social trading community | Limited customisation on charts |

| FCA regulated | Inactivity fees |

| Wide asset selection | Withdrawals can be slow |

Pricing

- Stocks and ETFs: 0% commission

- CFDs: Variable spreads

- Minimum deposit: £10

Best For Beginners Starting Day Trading

- New traders — Copy strategies from experts without advanced technical skills.

- Part-time traders — Easy-to-use platform for casual trading.

- Crypto-curious investors — Access digital assets alongside traditional ones.

- Students and freelancers — Start with low deposit requirements.

Use eToro’s demo account to practice strategies before risking real money. Many traders overlook this free tool, but it’s a safe way to test ideas without losses.

Best Alternate

Trading 212 offers similar commission-free trading but with fractional shares, making it more flexible for traders with smaller accounts.

2. IG Group – Professional-Grade Day Trading

IG Group is one of the most established UK day trading platforms, founded in 1974 and regulated by the FCA. It’s especially popular among experienced traders who want access to advanced trading tools, spread betting, and a wide range of markets.

Key Features

Spread Betting

IG is one of the few platforms in the UK that excels in spread betting. This allows traders to speculate on price movements while taking advantage of UK tax benefits.

ProRealTime Charts

The platform integrates with ProRealTime, offering advanced charting and technical analysis features that professional traders rely on.

Market Access

With IG, traders can access over 17,000 markets, including forex, indices, shares, commodities, and cryptocurrencies.

Educational Resources

IG Academy provides in-depth courses, webinars, and daily market analysis to sharpen trading skills.

High-Speed Execution

The platform is known for its fast order execution, which is critical for short-term traders aiming to capture small price movements.

Pros & Cons

| Pros | Cons |

| FCA regulated | High minimum deposit (£250) |

| Wide market access | Steeper learning curve |

| Advanced charting tools | Some fees on smaller trades |

| Strong research tools | Complex interface for beginners |

Pricing

- Spread betting and CFD spreads start from 0.6 pips

- Minimum deposit: £250

- Commission-free on US shares, with small fees on UK/EU shares

Best For Experienced Day Traders in the UK

- Advanced traders — Access professional-grade tools like ProRealTime.

- UK residents — Take advantage of tax-free spread betting.

- Active traders — Wide market access for diverse strategies.

- Forex traders — Benefit from low spreads and fast execution.

If you’re new to IG, start with the demo account to get used to the complex interface before trading live.

Best Alternate

Saxo Markets offers a similar professional feel but caters more toward institutional-grade multi-asset traders.

3. Saxo Markets – Multi-Asset Powerhouse for UK Traders

Saxo Markets is a premium UK day trading platform tailored for professional and high-net-worth traders. With access to more than 40,000 instruments across global markets, it’s one of the most comprehensive platforms available.

Key Features

Wide Market Coverage

Saxo gives UK traders access to equities, forex, bonds, ETFs, options, futures, and commodities, making it an excellent choice for those running multi-asset strategies.

SaxoTraderGO Platform

This proprietary platform delivers clean design, advanced charting, and risk management tools that cater to both discretionary and systematic traders.

Professional-Grade Research

Saxo offers in-depth market research, trading ideas, and analysis directly integrated into the platform, which is particularly useful for day traders who rely on fresh insights.

Tiered Account Levels

Traders can choose from Classic, Platinum, or VIP accounts, each offering different spreads, commissions, and service levels.

FCA Regulation

Being fully regulated in the UK ensures security and compliance for traders.

Pros & Cons

| Pros | Cons |

| Massive market selection | High minimum deposit (£500) |

| Professional trading platform | Fees can be higher for small accounts |

| Advanced risk management tools | Best suited for experienced traders |

| Tiered accounts with perks | Customer support prioritised for VIPs |

Pricing

- Forex spreads from 0.4 pips (with commission)

- Minimum deposit: £500

- Equity commissions from £3 per trade

Best For Professional UK Day Traders

- High-volume traders — Benefit from lower spreads in Platinum/VIP tiers.

- Multi-asset traders — Access to global equities, options, and futures.

- Experienced traders — Advanced charting and execution tools.

- Serious investors — Prioritised service with VIP accounts.

Saxo’s VIP account offers custom pricing and dedicated account managers, which can be a game-changer for large-volume day traders.

Best Alternate

Interactive Brokers is a strong alternative with direct market access and lower commissions, ideal for traders who don’t need Saxo’s VIP perks.

4. Trading 212 – Commission-Free Trading for UK Investors

Trading 212 is one of the most popular UK day trading platforms thanks to its commission-free model and easy entry point. It’s especially attractive for beginners and retail traders who want to start with small amounts while accessing global markets.

Key Features

Commission-Free Trading

Trading 212 allows you to buy and sell stocks, ETFs, and fractional shares without paying commission, making it perfect for frequent day trading.

Fractional Shares

This feature lets UK traders buy a portion of expensive stocks like Amazon or Tesla, which is ideal for smaller accounts.

Intuitive Mobile App

The Trading 212 app is clean and user-friendly, while still offering technical indicators, price alerts, and risk management tools.

Practice Mode

A £50,000 demo account is included, giving new traders the chance to practice without financial risk.

AutoInvest

With AutoInvest, traders can set up recurring investments and pie-style portfolios, combining long-term and day trading strategies.

Pros & Cons

| Pros | Cons |

| Zero-commission trading | Limited advanced tools |

| Fractional shares | No multi-asset futures/options |

| Low deposit (£1) | Not ideal for pro traders |

| Simple mobile app | Some outages in peak trading |

Pricing

- Stocks/ETFs: 0% commission

- CFDs: Variable spreads

- Minimum deposit: £1

Best For Beginner and Retail UK Traders

- New investors — Start with £1 and practice with a free demo.

- Small account traders — Use fractional shares for expensive stocks.

- Casual day traders — Commission-free access to global equities.

- Mobile-first traders — Easy-to-use app with good functionality.

Many traders don’t realise you can open two separate accounts with Trading 212 — one for Invest (stocks/ETFs) and another for CFD trading. This allows you to separate long-term investing from short-term day trading.

Best Alternate

eToro offers commission-free trading too but adds CopyTrading, which can be better for beginners who want to follow expert strategies.

5. Interactive Brokers – Direct Market Access for Serious Traders

Interactive Brokers (IBKR) is widely recognised as one of the most powerful UK day trading platforms, offering direct market access, low commissions, and advanced execution tools. It’s particularly suited for high-volume and professional traders.

Key Features

Direct Market Access

IBKR gives traders the ability to route orders directly to global exchanges, ensuring faster execution and tighter spreads than many competitors.

Wide Asset Coverage

With access to stocks, ETFs, futures, options, forex, and bonds across 150+ global markets, traders can diversify their strategies with ease.

Tiered Pricing

IBKR offers both fixed and tiered commission models, allowing high-volume traders to benefit from reduced fees.

Trader Workstation (TWS)

The TWS platform is an industry standard for professional traders, offering advanced charting, algo trading, and complex order types.

Risk & Portfolio Analysis

Powerful tools to monitor portfolio exposure and simulate market scenarios, which is critical for active day traders managing multiple positions.

Pros & Cons

| Pros | Cons |

| Direct market access | Complex interface for beginners |

| Extremely low fees | High learning curve |

| Wide market access | Inactivity fees on small accounts |

| Advanced tools (TWS) | Overwhelming for casual traders |

Pricing

- UK share commission: from £3

- Forex spreads: from 0.1 pips + commission

- No minimum deposit (but higher funding recommended for margin accounts)

Best For High-Volume and Professional UK Traders

- Active traders — Benefit from lowest fees and direct market access.

- Professional traders — Advanced order types and risk controls.

- Multi-asset traders — Access equities, futures, and forex globally.

- Algo traders — Use APIs for automated strategies.

Use IBKR’s paper trading account to test advanced order routing and algo scripts before applying them in live markets. It’s a hidden gem for strategy testing.

Best Alternate

Saxo Markets provides similar professional-grade tools but is often preferred by UK traders who want tiered VIP accounts and managed services.

6. Plus500 – CFD Trading Made Accessible

Plus500 is a well-known UK day trading platform that focuses on CFDs (Contracts for Difference). It’s designed for traders who want a simple, intuitive interface without being overloaded by complex tools.

Key Features

CFD Specialisation

Plus500 gives traders access to thousands of CFDs on shares, forex, indices, commodities, and crypto. This flexibility allows quick switching between volatile markets.

Simple Interface

The platform is streamlined, making it easy for beginners to place trades without struggling with advanced settings.

Negative Balance Protection

UK traders benefit from built-in protection, ensuring they can’t lose more than their deposit during high volatility.

Risk Management Tools

Features like stop-loss, trailing stop, and guaranteed stop orders help traders control risk effectively.

FCA Regulation

As an FCA-regulated broker, Plus500 ensures funds are held securely and operates with compliance.

Pros & Cons

| Pros | Cons |

| Intuitive platform | Limited advanced tools |

| Wide CFD offering | No direct stock ownership |

| Negative balance protection | Few educational resources |

| Regulated by FCA | No integration with MT4/MT5 |

Pricing

- No commissions (spreads only, starting around 0.6 pips)

- Minimum deposit: £100

Best For Beginner CFD Traders in the UK

- New CFD traders — Straightforward platform with easy execution.

- Risk-conscious traders — Negative balance protection adds security.

- Part-time traders — Quick access without needing deep charting tools.

- Mobile-first users — Clean, responsive trading app.

Many traders overlook Plus500’s Guaranteed Stop Orders, which lock in maximum loss regardless of market gaps. This feature is invaluable during high-volatility events.

Best Alternate

Capital.com offers CFDs too but includes AI-powered insights for traders who want extra analytics beyond execution.

7. CMC Markets – Advanced Charting for Active UK Traders

CMC Markets is one of the longest-standing UK day trading platforms, founded in 1989 and regulated by the FCA. It’s highly respected for its advanced charting tools, wide CFD range, and strong reputation for execution speed.

Key Features

Next-Generation Platform

CMC’s proprietary platform offers over 80 technical indicators, 70 chart patterns, and customizable layouts, making it ideal for technical day traders.

CFD and Forex Access

Traders can access CFDs across shares, commodities, indices, and over 330 forex pairs, one of the broadest selections in the UK.

Educational Resources

CMC provides daily market insights, webinars, and a comprehensive learning hub to support beginner and intermediate traders.

Risk Management Features

Guaranteed stop-loss orders, price alerts, and order boundaries help manage fast-moving trades effectively.

Mobile App

The CMC mobile app mirrors the desktop platform with advanced features, ensuring traders never miss opportunities on the go.

Pros & Cons

| Pros | Cons |

| FCA regulated | Higher minimum deposit (£200) |

| Excellent charting tools | Steeper learning curve |

| Large forex and CFD selection | Overnight holding fees |

| Strong educational content | Complex for casual users |

Pricing

- Spreads on forex pairs from 0.7 pips

- Share CFD commissions from £10

- Minimum deposit: £200

Best For UK Traders Who Rely on Technical Analysis

- Active day traders — Over 80 technical indicators and charting tools.

- Forex traders — One of the widest selections of pairs in the market.

- Chart-focused traders — Ideal for those who trade on price patterns.

- Intermediate traders — Supported by rich educational content.

Use CMC’s pattern recognition scanner. It automatically highlights candlestick and technical setups, saving hours of manual chart analysis.

Best Alternate

Pepperstone is a strong alternative for traders who want similar forex focus but with MetaTrader 4/5 integration and tighter spreads.

8. AvaTrade – Forex and CFD Trading with MT4/MT5

AvaTrade is a global broker with a strong presence in the UK, regulated by the FCA. It stands out as one of the best UK day trading platforms for forex and CFD traders who prefer the familiarity of MetaTrader 4 and MetaTrader 5.

Key Features

MT4 and MT5 Access

AvaTrade offers both MetaTrader platforms, making it attractive for traders who rely on algorithmic strategies, custom indicators, or expert advisors (EAs).

Wide Asset Coverage

Traders get access to forex, indices, stocks, commodities, and crypto CFDs, allowing for short-term opportunities across multiple markets.

AvaOptions

Unique to AvaTrade, AvaOptions provides a platform for trading vanilla forex options with advanced risk/reward tools.

AvaProtect

This risk-management feature allows traders to protect a trade for a set period, refunding losses during volatile market conditions.

Mobile Trading

AvaTradeGO, the broker’s mobile app, is intuitive and integrates seamlessly with account management and trading features.

Pros & Cons

| Pros | Cons |

| Supports MT4/MT5 | Limited research tools compared to IG |

| Wide market range | No direct stock ownership |

| Innovative features like AvaProtect | Higher spreads on some assets |

| FCA regulated | Customer service can be slow |

Pricing

- Forex spreads start from 0.9 pips

- CFD commissions are included in spreads

- Minimum deposit: £100

Best For UK Forex and CFD Traders Who Value MT4/MT5

- Algorithmic traders — Full MetaTrader compatibility for EAs.

- Forex traders — Competitive spreads on major pairs.

- Options traders — Use AvaOptions for advanced strategies.

- Risk-conscious traders — AvaProtect reduces downside risk.

AvaProtect is most useful during major events like central bank announcements. Many traders ignore it, but it can safeguard accounts against unpredictable volatility.

Best Alternate

Pepperstone also offers MT4/MT5 but adds ultra-tight spreads and faster execution, making it better for scalpers.

9. Pepperstone – Fast Execution for Forex Day Traders

Pepperstone is a popular UK day trading platform for forex and CFD traders who prioritise speed and low spreads. Founded in 2010 and FCA regulated, it has built a strong reputation among scalpers and algorithmic traders.

Key Features

Low Spreads

Pepperstone is known for its tight spreads, with major forex pairs often starting as low as 0.0 pips on Razor accounts, plus a small commission.

Execution Speed

The platform is optimised for lightning-fast execution, making it a top choice for scalpers and day traders who rely on precision timing.

Platform Choice

Pepperstone supports MT4, MT5, and cTrader, giving traders flexibility depending on their strategy and preference.

Scalping and Hedging Allowed

Many UK brokers place restrictions on these strategies, but Pepperstone welcomes both, making it attractive to advanced traders.

Market Range

Traders can access forex, indices, commodities, shares, and crypto CFDs.

Pros & Cons

| Pros | Cons |

| Ultra-low spreads | £200 minimum deposit |

| Lightning-fast execution | No proprietary platform |

| MT4, MT5, cTrader support | Limited research tools |

| FCA regulated | Overnight holding costs on CFDs |

Pricing

- Razor Account: spreads from 0.0 pips + commission (£2.25 per side per 100k traded)

- Standard Account: spreads from 1.0 pip (no commission)

- Minimum deposit: £200

Best For UK Forex Traders Who Need Speed

- Scalpers — Take advantage of near-zero spreads and fast execution.

- Algo traders — APIs and MetaTrader compatibility for automation.

- High-volume forex traders — Competitive commissions with Razor accounts.

- Hedgers — Flexible trading strategies without restrictions.

Many scalpers use Pepperstone’s cTrader platform for its advanced order types and depth of market (DOM), which often performs better than MT4/MT5 for execution-heavy strategies.

Best Alternate

AvaTrade also supports MT4/MT5 but offers AvaProtect, which may suit traders looking for extra risk management rather than ultra-low spreads.

10. City Index – FCA-Regulated Day Trading Platform

City Index, part of the StoneX Group, is a trusted UK day trading platform with more than 35 years of history. It’s particularly popular with traders who want a UK-focused broker offering spread betting, CFDs, and forex with strong regulation.

Key Features

FCA-Regulated Broker

As a UK-based and FCA-regulated platform, City Index offers a high level of security and trust for retail traders.

Spread Betting and CFDs

Traders can choose between spread betting (with potential UK tax advantages) and CFDs across multiple asset classes.

Advanced Charting

City Index provides 80+ technical indicators, drawing tools, and multiple chart layouts, making it suitable for technical day traders.

Daily Market Analysis

The platform offers research reports, news updates, and economic calendars to keep traders informed.

Mobile App and Web Trader

A smooth and reliable app plus browser-based access makes it convenient for trading without installing heavy software.

Pros & Cons

| Pros | Cons |

| FCA regulated | Minimum deposit £100 |

| Good charting tools | Not as advanced as IG |

| Spread betting available | Limited crypto assets |

| Strong research content | Higher spreads vs specialist brokers |

Pricing

- Forex spreads from 0.5 pips

- Commission-free on most markets (spread-only pricing)

- Minimum deposit: £100

Best For UK Traders Who Value Local Regulation

- UK-based traders — FCA oversight ensures safety and compliance.

- Beginner day traders — Intuitive platform with fair minimum deposit.

- Spread bettors — Take advantage of tax-free profits in the UK.

- Technical traders — Advanced charts with 80+ indicators.

Many traders don’t realise City Index offers a performance analytics tool that tracks win rates, average profits, and risk exposure. It’s a great way to refine strategies over time.

Best Alternate

Spreadex is another UK-focused platform, but it specialises in spread betting with lower entry requirements for beginners.

11. Spreadex – Low-Cost Spread Betting for UK Traders

Spreadex is a unique UK day trading platform that combines financial spread betting with sports betting, making it stand out from other brokers. It’s fully FCA regulated and particularly popular with traders who want a low-cost entry point into spread betting.

Key Features

Spread Betting Focus

Unlike many competitors, Spreadex specialises in spread betting, allowing UK traders to benefit from potential tax-free profits on gains.

Low Minimum Stakes

Traders can start betting with as little as £1 per point, making it more accessible for beginners testing strategies.

Wide Market Range

Spreadex offers spread betting and CFDs on equities, forex, indices, commodities, and even cryptocurrencies.

Sports Betting Integration

A rare feature, Spreadex allows users to combine sports and financial spread betting under one account.

Risk Management

Stop-loss orders and credit limits ensure traders don’t overextend on risky positions.

Pros & Cons

| Pros | Cons |

| FCA regulated | No commission-free stock trading |

| Tax-free spread betting | Limited charting tools vs IG |

| Low-cost entry (£1 stake) | Smaller product range than big brokers |

| Dual trading + sports betting | No MT4/MT5 support |

Pricing

- Spread betting stakes from £1 per point

- Minimum deposit: £1 (varies by account type)

Best For UK Traders Who Want Simple Spread Betting

- Beginner spread bettors — Start trading with just £1 stakes.

- UK tax-savvy traders — Potentially avoid capital gains tax on profits.

- Part-time traders — Easy-to-use platform without complex tools.

- Sports bettors — Manage both financial and sports bets in one place.

Many users overlook Spreadex’s monthly trading statements, which break down performance trends. Reviewing these can reveal valuable insights into your trading patterns.

Best Alternate

City Index also offers spread betting, but with more advanced charting tools and stronger research resources.

12. XTB – Advanced Trading with xStation 5

XTB is a global broker with a strong presence in the UK, known for its xStation 5 platform and focus on forex and index trading. It’s FCA regulated and appeals to traders who want advanced functionality without paying high commissions.

Key Features

xStation 5 Platform

XTB’s proprietary platform is packed with tools: heatmaps, trader sentiment, integrated news, and advanced charting. It’s faster and more modern than many broker platforms.

Zero-Commission Stock CFDs

Trade stock and ETF CFDs with no commission, paying only spreads. This makes it competitive for day trading high volumes.

Rich Education and Market Analysis

XTB offers daily video analysis, trading courses, and economic calendars to support both new and intermediate traders.

Wide Market Range

Access forex, indices, commodities, crypto CFDs, and equities with competitive spreads.

FCA Regulation

As a fully FCA-regulated broker, XTB provides a secure trading environment.

Pros & Cons

| Pros | Cons |

| xStation 5 packed with tools | No MT4/MT5 support for new clients |

| FCA regulated | Limited direct stock ownership |

| Zero-commission CFDs | Overnight fees on CFDs |

| Excellent research & education | Spreads wider on some assets |

Pricing

- Stock/ETF CFDs: commission-free (spreads only)

- Forex spreads: from 0.1 pips on top accounts

- Minimum deposit: £0

Best For UK Traders Who Want Advanced Tools Without High Fees

- Technical traders — Use xStation 5 for in-depth charting and sentiment.

- Forex traders — Competitive spreads on major pairs.

- Index traders — Strong range of CFD indices.

- Cost-conscious traders — Zero commissions on stocks/ETFs.

Many traders underuse XTB’s trader sentiment tool, which shows the percentage of clients long vs short. It can be a powerful contrarian indicator for day trading.

Best Alternate

CMC Markets offers equally advanced charting but provides broader forex coverage and MT4 support.

13. Capital.com – AI-Powered Risk Management

Capital.com has quickly grown into one of the most popular UK day trading platforms, especially for retail traders who value AI-driven insights and low entry requirements. With FCA regulation and a strong focus on user-friendly tools, it bridges the gap between beginners and intermediate traders.

Key Features

AI-Powered Insights

Capital.com uses machine learning to highlight trading patterns, common mistakes, and portfolio risks, helping traders improve performance.

Low Minimum Deposit

With just £20 required to start, it’s one of the most accessible brokers for UK traders.

Wide Asset Coverage

Trade over 3,000 markets, including forex, shares, indices, commodities, and cryptocurrencies.

Commission-Free Trading

Capital.com charges no commissions on trades, relying on spreads only, which is ideal for frequent day traders.

Education and Research Hub

The broker provides trading guides, webinars, and in-app educational modules to support continuous learning.

Pros & Cons

| Pros | Cons |

| FCA regulated | No MT4/MT5 support |

| AI-powered risk management | Limited advanced tools vs pro brokers |

| Low deposit (£20) | Overnight fees on CFDs |

| Commission-free trading | No direct stock ownership |

Pricing

- Spreads only (no commission)

- Forex spreads from 0.6 pips

- Minimum deposit: £20

Best For Beginners Who Want Guidance Through AI Tools

- New traders — Start with £20 and get AI-driven learning.

- Part-time traders — Easy-to-use app with smart risk tools.

- Mobile traders — Capital.com’s app is one of the best rated.

- Cost-conscious traders — No commissions on stock CFDs.

Use Capital.com’s AI insights dashboard regularly. It flags repeated mistakes like over-leveraging or trading at volatile hours, which can make a real difference to long-term results.

Best Alternate

XTB offers similar commission-free CFD trading but with xStation 5, which appeals more to advanced technical traders.

14. Fineco Bank – Multi-Market Access for UK Traders

Fineco Bank is an Italian bank with a strong UK presence, offering a multi-market trading platform that appeals to traders who want access to both UK and European markets. Fully FCA regulated, it combines banking services with advanced trading capabilities.

Key Features

Wide Market Access

Fineco allows trading in equities, ETFs, bonds, futures, options, and forex across global exchanges, making it a strong choice for multi-asset traders.

Direct Exchange Access

Unlike many CFD-only brokers, Fineco provides direct access to exchanges, enabling real stock and derivative trading.

Integrated Banking and Trading

UK clients benefit from both trading and banking services in one platform, with seamless account management.

PowerDesk Platform

Fineco’s proprietary trading platform, PowerDesk, includes advanced charting, customisable workspaces, and order-routing options.

FCA Regulation

Being FCA regulated ensures high standards of security and compliance for UK traders.

Pros & Cons

| Pros | Cons |

| Multi-asset market access | Minimum deposit £100 |

| Direct exchange trading | Platform can feel complex |

| FCA regulated | Less beginner-friendly |

| Integrated banking + trading | Higher fees for casual traders |

Pricing

- Stock trading commissions from £2.95

- Futures/options fees vary by exchange

- Minimum deposit: £100

Best For UK Traders Who Want Real Exchange Access

- Multi-asset traders — Trade shares, futures, and options globally.

- UK/EU equity traders — Access London, Milan, and Frankfurt markets.

- Professional traders — Customisable PowerDesk platform.

- Serious investors — Combine banking with advanced trading tools.

Fineco’s PowerDesk platform includes a time & sales window, giving traders real-time insight into market orders — a powerful feature often overlooked.

Best Alternate

Saxo Markets is also excellent for multi-asset trading but offers tiered account levels for high-volume clients.

15. Degiro – Low-Cost Stock Trading Across Europe

Degiro is a Dutch broker with a strong UK client base, well-known for its ultra-low fees on stock and ETF trading. Unlike CFD-focused brokers, Degiro offers real stock ownership, making it attractive for UK day traders who want exposure to both local and European markets.

Key Features

Low-Cost Trading

Degiro charges some of the lowest fees in the industry, with UK and US share trades starting at just £0.50 + commission.

Wide Market Access

Traders can access more than 50 global exchanges, including the London Stock Exchange, NYSE, NASDAQ, and European markets.

Real Stock Ownership

Unlike CFD platforms, Degiro allows you to actually own the underlying shares, which can be better for long-term traders who also want to day trade.

Research and Analysis Tools

Degiro provides a basic but functional research hub, economic calendar, and real-time quotes on major markets.

FCA Oversight

Although headquartered in the Netherlands, Degiro is passported into the UK under FCA regulation, ensuring client protection.

Pros & Cons

| Pros | Cons |

| Extremely low trading fees | No forex or crypto CFDs |

| Real stock ownership | Limited charting tools |

| Wide global exchange access | No demo account |

| FCA oversight | Not ideal for advanced day traders |

Pricing

- UK shares: from £1.75 + 0.014% per trade

- US shares: from £0.50 + $0.004 per share

- Minimum deposit: none required

Best For UK Traders Who Want Low Fees on Real Stocks

- Cost-conscious traders — Some of the lowest commissions in the UK.

- European market traders — Direct access to EU exchanges.

- Stock investors — Real ownership instead of CFDs.

- Long-term traders with side day trading — Dual benefits in one account.

Degiro’s US trading fees are among the lowest globally. Many UK day traders use it exclusively for fast-moving US stocks due to cheaper commissions than most UK brokers.

Best Alternate

Hargreaves Lansdown also offers real stock ownership, but with stronger UK research tools and customer support.

16. Hargreaves Lansdown – Trusted UK Stockbroker

Hargreaves Lansdown (HL) is one of the most established UK day trading platforms, primarily focused on shares, funds, and ETFs. While best known as an investment platform, its reliable service and research tools also make it suitable for active traders.

Key Features

Wide Range of UK Shares

HL gives direct access to the London Stock Exchange, AIM stocks, and a wide variety of funds, making it strong for UK-focused traders.

Research and Insights

The platform is highly respected for its daily market analysis, share screeners, and fund research, helping traders make informed decisions.

Strong Reputation

With over 1.7 million UK clients, HL is one of the most trusted stockbrokers in the country.

Web and Mobile Trading

The mobile app and web platform are straightforward, giving traders quick access to markets without unnecessary complexity.

Investor Protection

As an FCA-regulated broker with FSCS protection, funds are safeguarded up to £85,000.

Pros & Cons

| Pros | Cons |

| FCA regulated and FSCS protection | Higher trading fees vs rivals |

| Access to UK and global stocks | Not designed for scalpers |

| Excellent research tools | Limited CFD/forex options |

| Trusted brand with 30+ years history | Minimum deposit £100 |

Pricing

- UK shares: £11.95 per trade (discounts for frequent traders)

- International shares: £5.95–£11.95 depending on volume

- Minimum deposit: £100

Best For UK Stock Traders Who Value Research and Trust

- Long-term traders — Access to a wide choice of funds and shares.

- Day traders in UK equities — Fast execution on LSE and AIM markets.

- Research-focused traders — Comprehensive analysis and screeners.

- Conservative investors — Extra reassurance with FSCS protection.

Frequent traders should take advantage of HL’s discounted trading fees, which drop as low as £5.95 per trade if you execute more than 20 trades per month.

Best Alternate

Fidelity UK also offers real share dealing with strong research, but with slightly lower fees for active traders.

17. Fidelity UK – Long-Term and Active Traders Alike

Fidelity UK is another trusted name in the UK day trading platform space, offering stock, ETF, and fund trading with a reputation for strong research and customer support. While Fidelity is traditionally geared towards investors, its tools also suit active traders who value analysis-driven decisions.

Key Features

Broad Investment Choice

Fidelity UK offers access to UK, US, and international shares, ETFs, and funds, giving traders plenty of opportunities across markets.

Research and Market Insights

Known for its in-depth market research, analyst ratings, and insights, Fidelity helps traders who want data-backed decision-making.

Easy-to-Use Platform

The platform is beginner-friendly, with a straightforward interface suitable for both casual investors and regular day traders.

Educational Resources

Traders benefit from guides, webinars, and planning tools, which can help refine trading strategies.

FCA Regulation and FSCS Protection

Clients’ funds are protected, giving extra peace of mind.

Pros & Cons

| Pros | Cons |

| FCA regulated with FSCS protection | Fewer advanced tools for pros |

| Strong market research | Higher fees than discount brokers |

| Global stock access | No CFD or forex trading |

| Easy-to-use platform | Less suited for scalping |

Pricing

- UK shares: £10 commission per trade

- Frequent trader discount: £7.50 per trade (if 9+ trades per month)

- Minimum deposit: £100

Best For UK Traders Who Want Solid Research With Trading

- Research-driven traders — Benefit from Fidelity’s analysis tools.

- Long-term investors — Strong choice of funds and ETFs.

- Part-time traders — Simple, reliable platform without clutter.

- Cautious investors — Extra security via FSCS protection.

Many UK day traders use Fidelity for US market access, taking advantage of its research on Wall Street stocks that’s often deeper than competitors.

Best Alternate

Hargreaves Lansdown offers similar services but with more extensive UK company research and screeners.

18. Robinhood UK – Commission-Free US Stock Trading

Robinhood, the US-based broker, is officially launching its UK day trading platform in 2025. Known for commission-free trading, it’s expected to attract younger and cost-conscious traders who want easy access to US stocks and ETFs.

Key Features

Commission-Free Trading

Like its US counterpart, Robinhood UK will allow trading with zero commissions, making it highly attractive for active day traders.

US Market Focus

The platform will prioritise access to US stocks and ETFs, opening the door for UK traders to trade Wall Street names without high international fees.

User-Friendly App

Robinhood’s app is famously simple and intuitive, designed for fast trading on the go.

Fractional Shares

Traders can buy small slices of expensive US stocks, making it easier to diversify with limited capital.

Instant Deposits

Funds will be available to trade immediately after deposit, which is convenient for quick day trading moves.

Pros & Cons

| Pros | Cons |

| Zero commissions | Limited UK/EU stock access |

| Fractional shares | No advanced charting tools |

| Fast and easy to use | Reputation issues in US |

| Popular with younger traders | Limited features for pros |

Pricing

- Commission-free trading

- No minimum deposit expected (subject to UK launch details)

Best For UK Traders Who Want US Stock Access

- Younger traders — Low-cost, mobile-first access to US markets.

- Small account traders — Fractional shares make diversification easier.

- Day traders in US equities — Direct access without high UK broker fees.

- Part-time traders — Simple, quick trading without complexity.

Robinhood UK is expected to roll out options trading in the future. Keep an eye on updates, as this could give UK traders access to strategies usually restricted to US brokers.

Best Alternate

Degiro also provides access to US shares but with real stock ownership and more research tools.

19. TradeStation Global – Advanced Analytics for Active Traders

TradeStation Global is a joint venture between TradeStation and Interactive Brokers, giving UK traders access to a professional-grade platform with direct market connectivity. It’s a top choice for those who want advanced analytics, algorithmic trading, and custom indicators.

Key Features

Direct Market Access

TradeStation Global connects to Interactive Brokers’ infrastructure, offering direct execution across more than 130 markets worldwide.

Advanced Analytics

The platform provides powerful charting, over 40 years of historical data, and the ability to backtest strategies with precision.

EasyLanguage Scripting

Traders can create custom indicators, strategies, and automated systems using TradeStation’s proprietary EasyLanguage code.

Multi-Asset Coverage

Trade equities, options, futures, ETFs, and forex, making it suitable for diverse trading strategies.

FCA Oversight

UK clients benefit from regulation and protection, ensuring safe operations.

Pros & Cons

| Pros | Cons |

| Direct market access | Platform learning curve |

| Advanced backtesting | £0 minimum but funding required |

| Custom scripting (EasyLanguage) | Not beginner-friendly |

| Wide market access | Interface can feel dated |

Pricing

- Stock trades: from £3 per order

- Forex spreads: as low as 0.1 pips + commission

- Minimum deposit: technically £0 (though funding of at least £1,000 recommended for margin trading)

Best For UK Day Traders Who Want Advanced Customisation

- Algo traders — Build custom indicators and automated systems.

- High-volume traders — Low fees and fast market access.

- Multi-asset traders — Trade stocks, options, futures, and forex.

- Data-driven traders — Historical data for backtesting strategies.

TradeStation Global allows hybrid use of both Interactive Brokers’ TWS and TradeStation’s advanced analytics. Running them together gives traders the best of both platforms.

Best Alternate

Interactive Brokers is a close alternative for traders who want direct execution only without TradeStation’s custom scripting layer.

20. Markets.com – CFD and Forex Trading with WebTrader

Markets.com is a well-established UK day trading platform that focuses on CFDs and forex trading. It’s FCA regulated and designed for traders who want a balance between simplicity and advanced functionality through its WebTrader platform.

Key Features

WebTrader Platform

Markets.com offers its proprietary WebTrader, featuring advanced charting, technical indicators, and integrated sentiment tools.

Wide CFD Offering

Trade CFDs across forex, shares, indices, commodities, ETFs, and cryptocurrencies — all from a single account.

Educational Support

The platform provides webinars, tutorials, and an in-depth knowledge centre to support both beginners and intermediates.

Sentiment Indicators

Traders gain insights into how others are positioned in the market, helping guide trading decisions.

FCA Regulated

Client protection and compliance are ensured for UK traders.

Pros & Cons

| Pros | Cons |

| FCA regulated | No direct stock ownership |

| WebTrader with integrated tools | Overnight CFD fees |

| Wide CFD and forex coverage | Not ideal for pro traders |

| Sentiment indicators | £100 minimum deposit |

Pricing

- Spreads only (no commission)

- Forex spreads start from 0.6 pips

- Minimum deposit: £100

Best For UK Traders Who Want an All-in-One CFD Broker

- Beginner CFD traders — Easy entry point with £100 minimum.

- Forex traders — Competitive spreads and strong sentiment tools.

- Multi-asset day traders — Wide selection of CFDs in one account.

- Casual traders — Balance between simplicity and advanced features.

Markets.com’s sentiment indicators can help you spot contrarian trading opportunities — a powerful edge in volatile markets.

Best Alternate

Plus500 also focuses on CFD trading but offers an even simpler platform, making it better for absolute beginners.

Why These Are the Best 20 UK Day Trading Platforms

Choosing the right platform for day trading in the UK is critical. From commission-free apps like Trading 212 and eToro to professional-grade brokers like Interactive Brokers and Saxo Markets, this list covers every trading style and budget. The key takeaway is simple: the right platform can reduce costs, improve execution, and give you the tools to stay ahead in volatile markets.

How Pearl Lemon Invest Supports UK Day Traders

At Pearl Lemon Invest, we know that finding the best day trading platform is just one part of the journey. What matters just as much is having a strategy tailored to your goals, risk profile, and market focus. Our team works with traders and investors who want more than just broker access — they want an edge.

Whether you’re building your first trading portfolio or scaling advanced day trading strategies, we provide coaching, portfolio support, and access to market research that most retail traders miss. Don’t let platform choice be the only factor in your success. Partner with us and trade with confidence, knowing you’re supported by experienced professionals who understand what works in the UK markets.

FAQs

- How does Pearl Lemon Invest help UK traders choose the right day trading platform?

We provide personalised consultations where we review your trading style, risk profile, and goals to recommend the most suitable FCA-regulated platforms. - Can Pearl Lemon Invest manage my day trading portfolio?

Yes. We work with clients to design, monitor, and refine trading portfolios that match their risk tolerance and financial objectives. - Does Pearl Lemon Invest offer one-on-one day trading coaching?

Absolutely. Our experts provide hands-on coaching sessions to help traders develop skills in charting, risk management, and strategy execution. - Can you build custom trading strategies for me?

Yes. We create tailored trading plans using tested technical and fundamental approaches designed specifically for UK markets. - Does Pearl Lemon Invest provide training on forex day trading?

We offer structured training programmes that cover forex pair analysis, scalping, swing trading, and high-frequency trading techniques. - Do you help traders minimise taxes in the UK?

Yes. We guide clients on tax-efficient trading structures such as spread betting accounts, helping reduce liability where applicable. - Can you help me set up algorithmic trading?

Yes. Our team assists with the setup of automated systems on platforms like MetaTrader and Interactive Brokers. - Does Pearl Lemon Invest provide ongoing market research?

We deliver daily and weekly research updates covering equities, forex, indices, and commodities to support client trading decisions. - Do you work with beginners as well as experienced traders?

Yes. We support both new traders starting with small accounts and professionals managing larger portfolios. - How do I get started with Pearl Lemon Invest’s services?

You can book a consultation with our team to discuss your trading goals. We’ll then recommend a clear path, whether it’s coaching, portfolio support, or strategic planning.