Foreign exchange trading is a market in which traders purchase and sell currencies from other countries to earn.

The most popular kind of financial trading worldwide is forex trading. It entails purchasing and selling currencies from several nations to make money. The foreign currency market is accessible every year, twenty-four hours a day, seven days a week.

Forex, or simply FX, is another name for trading foreign exchange.

There are huge financial benefits for an investor who is willing to take the risk and trade currency. Foreign currency trading can be a very lucrative career path, especially if you’re at the top of your game. Forex trading is huge, and there are many traders who maintain a high level of success. While the top traders know each other and compete for larger sums of money, the rest of us should still learn from them and understand what their strategies are.

While margin trading is just one of the many aspects of forex success, it’s a vital one. Trading is easy and quick – meaning you can complete your trade within a few minutes. Check out this article about free margin for every foreign exchange trader to get more info.

Forex professionals generally exhibit many great characteristics. Let’s take a look at some of the other traits that are common among the world’s top traders.

Figures And More Figures

You may be thinking, “Wow, these traders are turning over incredible amounts of money yearly and monthly.” You might also have noticed that their percentage is truly impressive. Professional traders can expect to generate 5-15% per month profits. There may be a few big losses, but they are compensated for with their big wins elsewhere.

Top traders are making a lot of money & a lot faster too. The profit can reach up to £220,000! If you’re looking to generate profits at a fast pace and with high amounts, then this is one route to do it.

Factors Affecting Trade Performance

Forex trading uses a lot of capital and is dependent on how much you have. The top earners make a lot because they have the right strategies and strategies that help them win the game. As you saw in the above example, they’re able to generate big returns by doing this. A lot of the top traders in any sector or field use their personal wealth to leverage a large capital base. You might be able to create your own empire without being amongst the wealthiest and most successful, but that doesn’t mean it’s not possible and won’t happen for you.

Leverage can be a powerful tool, and when used correctly, it is also efficient. Some will argue that not believing in the power of leverage means they are missing out on a lot of opportunities as a trader. Leveraging yourself on any level comes with the risk of making a mistake. If you want to use leverage on a larger scale to your advantage, it’s important to remember that your risks can be negative or positive, depending on how much profit you wish to generate.

Many people will have a hard time making trades, and it can quickly affect your profitability. This will depend on the currencies you are trading and other variables. There is a real range to the volatility and potential for profit of different currencies. Some currencies are known as slow burners, and you might use them to make your first steps into trading. Others have a real “snap,” which means they tend to fluctuate more than other currencies and offer more upside potential when it comes to trading them.

What Makes A Professional Trader Stand Out Among The Rest

Because they have access to specialized tools and services, professional forex traders make up 1%. Casual traders might make up the remaining 99 per cent, but the instability of their market makes it challenging for them to turn a profit consistently. Professional traders have a unique approach to the market and frequently consider these elements before making a trading decision. They accomplish this while utilizing qualified equipment that offers high-quality services based on financial choices.

Traders that place trades fast and without a clear strategy frequently trade for long periods with subpar profits. They are renowned for showing emotion and being impatient. Some traders cannot earn from their trading, but others instead select strategies that appeal to their mental models. Focusing on and sticking with a plan gives a trader the highest chance of success.

The value of endurance and self-control cannot be understated while trading at a high level. Traders need to understand that feeling things will make things harder for them and ultimately cause them to lose more money. Traders must be prepared to be obedient and adhere to their rules. Although they may not always purchase or sell on trends, they consider their success or failure in light of how their portfolio performs.

It’s challenging to narrow down precisely what makes good traders successful. It might be explained by a confident yet measured mindset, exceptional research abilities, and the capacity to take risks and maximize their rewards. It’s also vital to remember that in forex trading, being punctual can be just as crucial as a specific mindset.

Crucial Forex Indicators

Moving Average

Traders use MAs (moving averages) to make decisions related to the market. Depending on the time frame, they might be used to figure out what’s happening in the few hours at hand or even an entire week. They can also be made custom for different trading windows and provide more flexibility than a static one. Combining multiple indicators like moving averages with other strategies is a great way to see if they are suggesting similar trends to one another: not only can you find more success in your trades, but you can also be confident the trend will continue. And the use of data from sales for over 100 years in forex markets proves its reliability.

Relative Strength Index (RSI)

This is a popular oscillator tool developed in the 1970s because, once launched, it alerts investors when they should start trading on an opportunity. Traders use AI to identify entry and exit positions and calculate when and where to place trailing stop-losses. They want to maximise profit without taking any extra risk by minimising it.

Bollinger Bands

Bollinger Bands are a great tool for traders and investors, making it easy to track volatility on a currency pair. This indicator has been around for a while now and is an effective way to provide more reliable information to investors who are considering trading forex. But input you need to remember is that Bollinger Bands aren’t the be-all-end-all of indicators, and they do have weaknesses that need to be considered.

Exponential Moving Average (EMA)

Bollinger Bands are similar to exponential moving average charts, which display price volatility while averaging out the volatility to smooth it out. It provides an accurate way of seeing the price trend without giving too much weight to price extremes. It is easy to interpret the EMA, and it can be adjusted to different time frames. Those who use them include inexperienced traders, as well as experienced ones.

Fibonacci Levels

There are a lot of critics who question the reliability of Fibonacci extension and retracement levels in forex. However, top traders always pay attention to the price action of a currency pair and the trading activity around them. Largely due to the widespread use of Fibonacci levels, traders are more likely to play a psychological game where they forecast price action by anticipating how other traders will act based on these support and resistance levels.

Important Economic Events

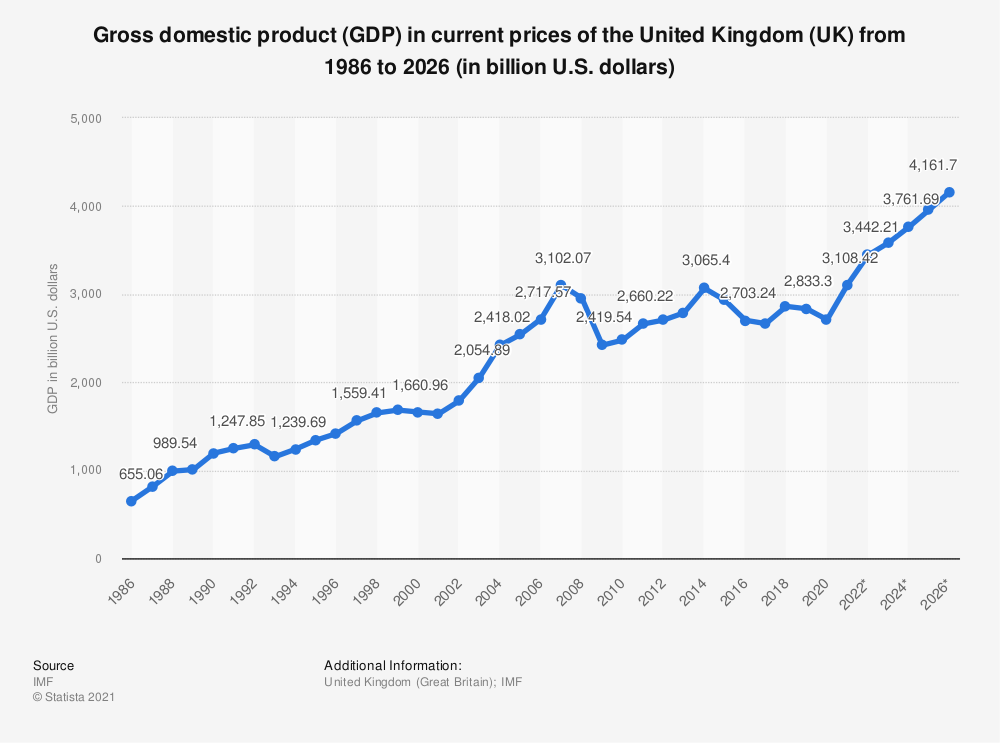

Gross Domestic Product

When it comes to an understanding of how the economy is doing, GDP reports can give you a good idea of what’s going on. They offer some clarity on where the country is economically and what actions need to be taken. Historically, said reports have had a significant impact on how traders at large will value a given currency, so they should be researched to understand the economy in addition to helping you find out whether you’re getting the best trade price. If you’re looking for more solid backing than that, top traders might also be interested in researching GDP numbers.

Non-Farm Payroll Report

Forex broker is always aware of important changes that affect their investments, which is one of the best ways to do. Data from the U.S. non-farm payroll report is a good source for forex information. It gives traders insights into how much money changes are being made in different industries and which industries show signs of recovery. These reports offer insight into trends that can affect the U.S. economy and the monetary products they use, which means your personal balances could be at risk if the subject matter you’re looking into is sensitive. The non-farm payroll report is one of the most important statistics in the economy. You can find a whole lot of different data in this document, including the overall labour market.

Consumer Confidence Index (CCI)

The CCI is a way traders can observe all things related to consumer confidence in the economy. It helps them understand current conditions using information that is not always included in other reports. There is a good chance that the consumer has faced financial challenges in their life & is pulling back from spending to save money. It’s easy for them to find more practical options and alternatives to bigger purchases.

Conclusion: Conquering Your Fear and Emotions

One of the toughest challenges that most first-time traders experience is making decisions based on emotion rather than rational thinking. However, this can sometimes make trading difficult-especially when you might be inexperienced.

Forex trading is a big part of investing in the market. I don’t know about you, but I’m always willing to complete it more objectively than others. Forex trading and investing point are to take advantage of opportunities in a volatile market that every investor knows can provide an opportunity for growth in their accumulation through research and data-driven analysis. Emotions can make you lose money when it comes to trading, so it’s essential to remain calm when in difficult situations. However, if you ignore signs that show you’ve made a mistake or take poor trades against tough odds, which provides an illusion of hope, your emotions have too much power, and your losses snowball.

A successful forex trader must have learned how to avoid impulse decisions and focus on the most important aspects of their business. They’ve achieved this by developing an iron-clad strategy to evaluate trades without any emotional input. In order to put their emotions aside, they’ve had to learn how to tap into their more rational brain. They practice staying committed to a specific trading strategy even if there is a lot of volatility in the market. For every trader, it’s important that they keep emotions out of their decision-making process and follow through with this strategy.

Frequently Asked Questions

How much do forex traders make an hour?

Forex traders make a lot of money. However, the amount that they make per hour is not very much.

Forex traders often trade in the currency market and buy and sell currencies. This can be done by using an online trading platform or by using a broker to trade on their behalf.

Forex trading is considered one of the most profitable trading strategies because it requires less capital than other types of investments. Through arbitrage, spread betting, futures contracts, and more, traders can earn through arbitrage, spread betting, futures contracts, and more.

Is Forex trading a full-time job?

Forex trading is a full-time job for many traders. It requires a lot of dedication and hard work to be successful in this field.

Forex trading is a full-time job for many traders. It requires a lot of dedication and hard work to be successful in this field.

Full-time trading does not mean that you have to trade continuously, but it does mean that you have to trade at least five days per week.

How long does it take to learn Forex?

This section discusses the time it takes to learn Forex. It also discusses why newbies should not be discouraged by the market and should stay positive.

Forex is a complicated market. It’s fast-paced and can change quickly. But don’t let that deter you from learning this market if you are interested in trading it.

The time to learn Forex depends on how much experience you have with trading and investing in general and how much information you want to know about the Forex market. The more information you have, the faster it will take to learn Forex because there will be fewer things for you to memorise or figure out on your own.